About the SSIF

How the SSIF Invests

Investment Philosophy

- The SSIF believes that equity markets are generally efficient; however, opportunities exist for a fundamental active strategy to outperform a passive benchmark.

- The SSIF aims to capitalize on these opportunities by focusing on mid-cap stocks that are potentially less researched than large-cap stocks, yet have sufficient liquidity and available value-relevant information.

- The SSIF’s competitive advantage originates from focused research and an unbiased student perspective of the market, operating outside of potential distractions of large investment management firms.

Investment Process

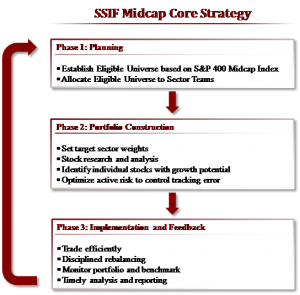

The SSIF Investment Process is designed to capitalize on the opportunities in the market in which a company’s price does not reflect its true fundamental value. In addition, specific features of the Investment Process manage tracking error – the risk of the strategy relative to its mid-cap core benchmark. The Investment Process can be thought of in three distinct stages: Planning; Portfolio Construction; and Implementation and Feedback.

The SSIF Investment Process is designed to capitalize on the opportunities in the market in which a company’s price does not reflect its true fundamental value. In addition, specific features of the Investment Process manage tracking error – the risk of the strategy relative to its mid-cap core benchmark. The Investment Process can be thought of in three distinct stages: Planning; Portfolio Construction; and Implementation and Feedback.

Planning

The process defines the eligible universe of available investments based on maintaining consistency with the mid-cap core mandate and the S&P 400 benchmark. Any stock within the S&P 400 Midcap Index is eligible for the portfolio. Up to 10% of the portfolio may be held in stocks outside the S&P 400 as long as the stocks are in the 10th to 90th capitalization percentile of the S&P 400 and are not constituents of the S&P 500 (large cap) or S&P 600 (small cap) indexes.

To facilitate focused fundamental research, stocks are allocated to sector teams based on the Global Industrial Classification sector membership. Sector teams include: Consumer Discretionary/Staples and Communication Services; Energy and Utilities; Financial Services; Healthcare; Industrials; Information-Technology; Materials; and Real Estate.

Portfolio Construction

The portfolio is constructed using a hybrid approach of fundamental research and quantitative optimization. The goal of the fundamental research is to give the portfolio the opportunity to outperform the benchmark by identifying stocks with growth potential. The quantitative aspect of the process aims to manage the risk of the portfolio relative to the benchmark.

Each sector team is responsible for selecting stocks within its sector for inclusion in the portfolio. Based on in-depth fundamental research, selected stocks represent those stocks with the most growth potential to contribute to the portfolio’s outperformance of the benchmark over time in the team’s view.

Using the stocks selected by the sector teams, each stock’s specific target weight is set by a quantitative optimization process. The process uses historical returns as an input to estimate the risk of the portfolio relative to the benchmark. Within target parameters, such as maintaining the portfolio to be sector-neutral, the optimization’s objective is to maximize a modified information ratio of the portfolio against the benchmark index.